Understanding the economic health of a nation relies heavily on scrutinizing various crucial indicators. For Canada, like any other country, these metrics provide insight into the country's economic trajectory and overall vitality. This article outlines some of the most significant indicators, including GDP, employment rates, and others, which help paint a comprehensive picture of Canada's economic situation.

Gross Domestic Product (GDP)

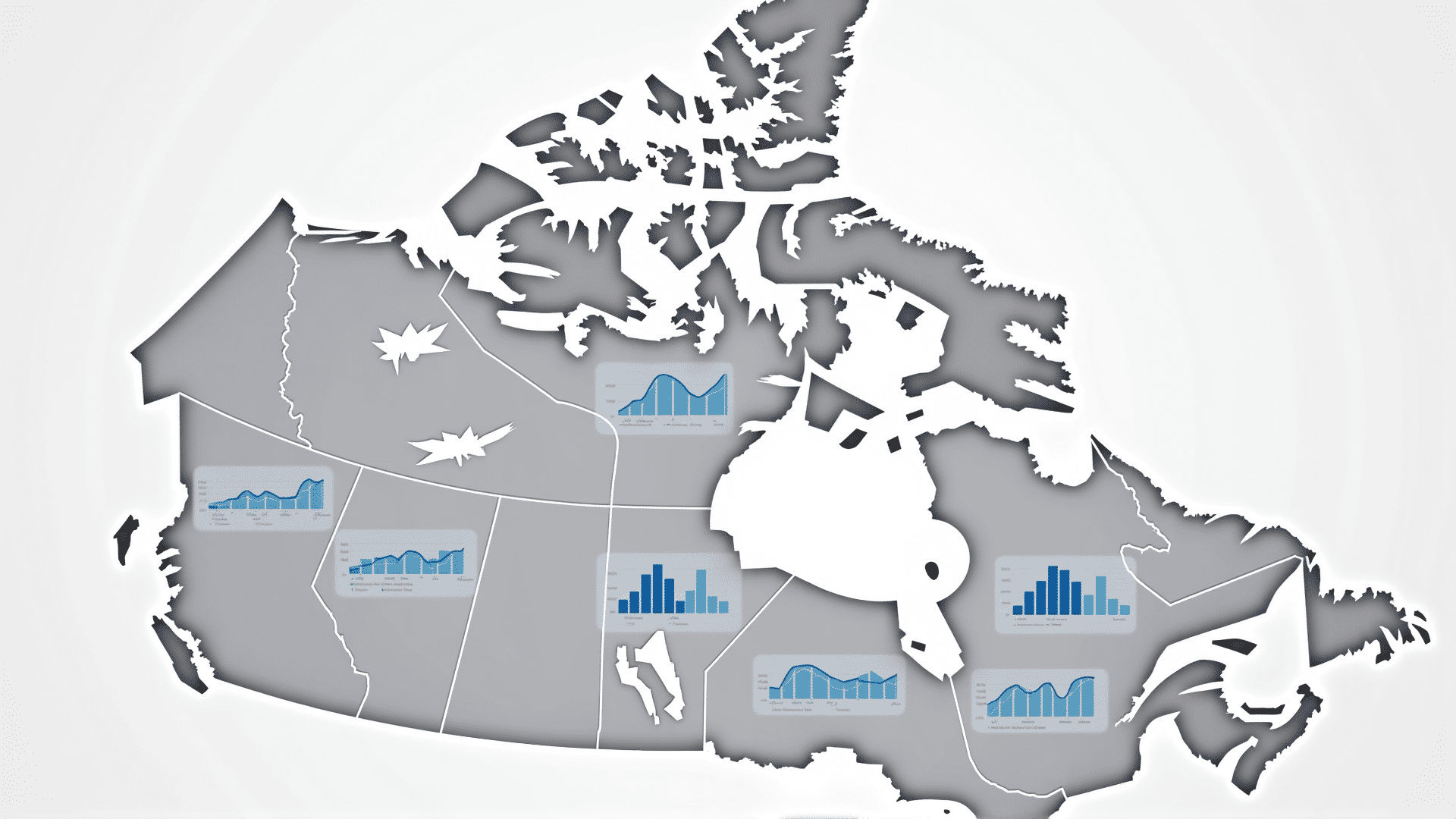

GDP is the foremost indicator of economic activity in a country. It measures the total value of all goods and services produced over a specified period. A growing GDP generally suggests a flourishing economy with potential for prosperity and higher living standards for citizens. In Canada, GDP fluctuations can provide insights on how different sectors are performing, indicating areas of strength and potential vulnerabilities.

Employment Rates

Employment is another critical measure of economic health. It reflects the proportion of the population that is actively engaged in productive activities. High employment rates usually coincide with increased consumer spending, which fuels further growth. Moreover, employment data can reveal trends in job creation in various industries across Canada, helping to identify which sectors are thriving or declining and thus directing workforce development efforts.

Consumer Price Index (CPI)

The Consumer Price Index is instrumental in tracking changes in the cost of living by examining the average change over time in the prices paid by consumers for a basket of goods and services. A rising CPI indicates that prices are increasing, which might point towards inflationary pressures. Monitoring the CPI helps policymakers ensure that inflation remains within a target range, thus maintaining economic stability.

Trade Balance

Canada’s economy is heavily influenced by international trade. The trade balance, which is the difference between exports and imports, is a crucial indicator. A positive balance suggests that the country exports more than it imports, contributing to economic growth. Conversely, a negative balance may signal challenges in competitiveness or a dependency on imported goods and services.

Retail Sales

Retail sales data are pivotal as they reflect consumer confidence and purchasing behavior. Rising retail sales typically indicate that consumers are optimistic about their financial future, leading to higher expenditure on goods and services. Assessing retail trends can provide valuable information on which areas of the economy are gaining momentum and how disposable income is being utilized across Canada.

Housing Starts

The construction of new homes, tracked by housing starts, serves as an important economic gauge. An increase in housing starts generally signifies robust economic health, as it implies demand for housing and potential growth in related industries like construction and manufacturing of building materials. It also indicates how secure Canadians feel in terms of long-term financial stability, leading them to invest in property.

Business Confidence

The level of optimism or pessimism exhibited by businesses regarding future economic conditions can also serve as a vital indicator. When business confidence is high, it often translates into expansion, hiring, and increased production, all boosting economic activity. Surveys and indices tracking business sentiments can therefore provide foresight into future economic developments.

Overall, the careful monitoring of these economic indicators is essential for assessing Canada's economic wellbeing and crafting informed policies. By analyzing data from GDP and employment rates to retail sales and housing starts, stakeholders can better understand current trends and forecast future developments, ensuring a resilient and prosperous economic environment.